On April 4, the U.S. bond market saw dramatic volatility. Traders expect the Fed to raise rates by 25 basis points at the May meeting with a 54.8% probability, up from 48.4% on Friday, while the probability of staying put for the month fell to 45.2% from the original 51.6%. The current pricing of interest rate swaps shows that the Fed is expected to cut its benchmark rate to about 4.316% by the end of the year. Yields on U.S. Treasuries of all maturities showed significant changes on the day. In addition, the ISM manufacturing purchasing managers’ index was just 46.3 in March, the lowest reading since May 2020 and well below market expectations of 47.5, indicating that the economy is experiencing a hard landing.

For detailed inside information, please see the following:

Caixin News Agency, April 4 (Editor Xiaoxiang) After the rare “turbulent March” in history, it is nothing new for investors in the U.S. bond market to see dramatic fluctuations in the bond market in one day. However, the first trading day in April, the market trend, perhaps still seems quite unusual, because the bond market long and short seem to have their own reasons to build positions on the day – just one day, the Federal Reserve “rate hikes” and “rate cuts” are expected to heat up… …

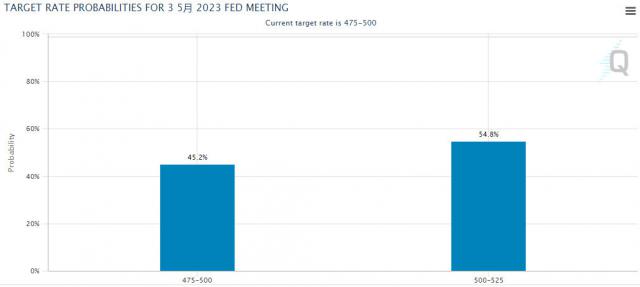

The rise in expectations for a rate hike was reflected in the pricing of rates for the May meeting. Chicagoland’s Fed Watch tool shows that traders now expect the Fed to raise rates by 25 basis points at next month’s meeting with a 54.8% probability, up from 48.4% on Friday, while the probability of staying put for the month has fallen to 45.2% from 51.6%.

The ferment of interest rate cut expectations is reflected in the pricing of year-end rates. Current interest rate swap pricing suggests that the Fed is expected to cut its benchmark rate to about 4.316% by the end of the year.

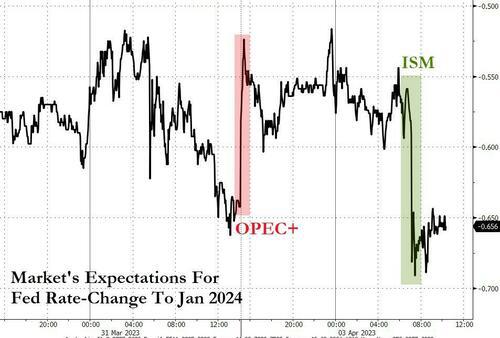

The change in interest rate expectations was in fact clearly reflected in the movement of U.S. bond yields across maturities on the day. At the opening of the Asian session on Monday, U.S. bond yields had jumped because of the spike in oil prices, but completely reversed their gains after the release of a subdued set of U.S. manufacturing PMI data in the New York session. Among them, the two-year U.S. bond yields, the most sensitive to interest rate policy, climbed 11 basis points earlier in the day, but eventually closed down by more than 7 basis points throughout the day.

By the end of the day, the 2-year U.S. bond yield finally fell 7.3 basis points to 3.963%, the 5-year U.S. bond yield fell 7.8 basis points to 3.5%, the 10-year U.S. bond yield fell 5.9 basis points to 3.414%, and the 30-year U.S. bond yield fell 2 basis points to 3.631%.

There is no doubt that what the bond market and interest rate market experienced on Monday is still not out of the core theme that has been lingering in the market for the past six months – how should the Fed and market participants choose between inflation and recession?

The bond market actually traded on the day with the following logic:

Initially in the Asian session: OPEC unexpectedly cut production over the weekend → oil prices soared → high inflation in the United States is difficult to cool down → the Fed still needs to raise interest rates in May → short U.S. bonds ( yields rose )

Then in the New York session: ISM manufacturing PMI is low → economic hard landing risk is rising → the Fed is likely to cut interest rates in the second half of the year → long U.S. bonds (yields are falling).

Last night’s economic data “bombshell”

In yesterday’s Asian session of the report, we have and investors have been introduced to the oil price surge may have an impact on various markets, but in the New York session, an unexpected data performance, and completely break the original trajectory of the market, then, this latest economic indicators reflect what information?

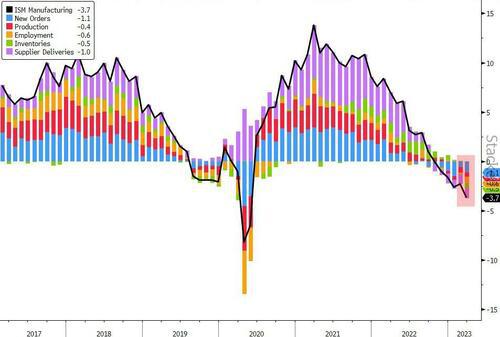

According to the data released by the Institute for Supply Management ( ISM ), the U.S. ISM manufacturing purchasing managers index in March only recorded 46.3, the lowest reading since May 2020, much weaker than the 47.7 in February and market expectations of 47.5. This is also the fifth consecutive month that the indicator is below the 50-year mark, indicating that the industry is in contraction.

The downturn in the ISM report is almost “all-encompassing”. All sub-indices are in contraction. These data suggest that rising interest rates, increased recession fears and tighter lending conditions may be starting to put significant pressure on business investment.

Christopher Rupkey, chief economist at FFwdbonds in New York, commented that manufacturing activity is slipping further into contraction, and the key question is whether the slowdown in factory output will spread to the rest of the economy. the sharp drop in new orders in March will likely lead to shutdowns or more layoffs later this spring and summer.

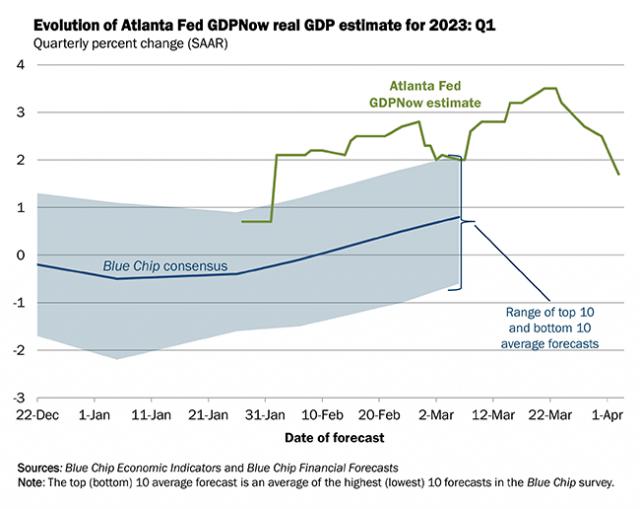

Following the release of this data, the Atlanta Fed’s GDPNow model’s latest estimate is that U.S. real GDP growth will likely be just 1.7 percent in the first quarter of 2023, well below the 2.5 percent projected last Friday (March 31).

The main takeaway from this report is that the job market is slowing,” said Jeffrey Roach, chief economist at LPL Financial, which is also an important signal for Fed officials who are currently relying on economic data performance to make decisions. A colder job market should ease some of the inflationary pressures the Fed is struggling to overcome.”

And to Paul Nolte, strategist at Murphy & Sylvest Wealth Management, the fact that the Fed previously said it relies on data to make decisions means two things.

“First, every data release point is important. Second, they (Fed officials) don’t really have a long-term plan for the economy. The lack of a plan means that investors are left to guess what action the Fed will take based on the latest economic data. This has led to dramatic market volatility.”

On the stock market, Chris Harvey, head of equity strategy at Wells Fargo, said the upcoming earnings season, with the possibility of a recession looking more certain, could be the first of several tough earnings seasons to come.