Deutsche Bank’s share price plunge on Friday caused panic in the market, with the market capitalization of the European bank stock index evaporating more than 30 billion euros in a short period of time. Regulators suspect that a 5 million euro Deutsche Bank credit default swap deal was one of the causes of the above panic. The transaction bets on swaps related to Deutsche Bank’s subordinated debt, and the lack of liquidity could trigger significant volatility. Although there is no evidence of wrongdoing in the deal, market participants remain concerned that the banking crisis could worsen. the turmoil in the CDS market has also added to the unease in the market, with investors fearing that the risk of European bank debt could trigger a larger economic crisis.

For detailed inside information, please see below:

Deutsche Bank did not fall as weakly as Silicon Valley Bank and Credit Suisse, but the turmoil staged during the day on Friday still made almost all market participants were scared out of their wits – Deutsche Bank shares plunged more than 10% without much warning, once the market suspected that another round of banking sector “weekend of life and death”, an index tracking European bank stocks evaporated more than 30 billion euros in a short period of time ……

And this week, more details about this Deutsche Bank plunge panic at the time, also finally gradually surfaced!

According to people familiar with the matter, regulators are now pointing the finger at a Deutsche Bank credit default swap ( CDS ) deal, which they suspect triggered last Friday’s general sell-off in Europe’s banking sector. The deal, worth about 5 million euros (about $5.4 million), was reportedly bet on swaps related to Deutsche Bank’s subordinated debt.

Regulators have spoken to market participants about the deal, people familiar with the matter said. The contracts may be illiquid, so a single bet could trigger significant volatility. A Deutsche Bank spokesman declined to comment.

It’s unclear who made the bets in question or why they did so. So far, there’s no evidence of any wrongdoing in the deal, people familiar with the matter said. One of the people familiar with the matter said some data suggests the deal may have been an attempt to hedge risk.

But it was the suspected knock-on effect of the deal that led to heavy losses in bank stocks, a surge in European government bond prices, a spike in CDS basis points, a one-day loss of about 1.6 billion euros in Deutsche Bank’s market value and the rapid evaporation of more than 30 billion euros in the market value of an index tracking European bank stocks on Friday ……

And there is no doubt that the “30 billion” behind the “5 million” is a reflection of the “panic” mentality of the European banking sector at the time. Investors in Europe and the US have been on edge for the past two weeks, with panicked traders looking for clues as to whether other banks might also be under pressure.

Has the CDS market become a source of panic?

CDS is a derivative contract that investors use to hedge their investments or to place bets on changes in corporate creditworthiness. the spike in CDS prices may reflect general anxiety about the banking system and the turmoil in riskier European bank debt.

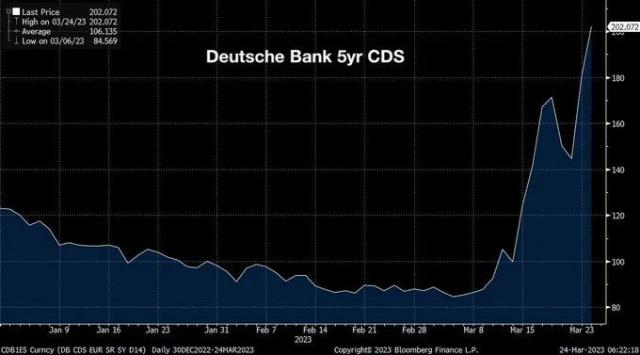

Deutsche Bank’s five-year CDS rose from less than 100 basis points two weeks ago to more than 200 basis points on Friday on growing concern that the German mega-bank could be the next financial institution under pressure after the collapse of three U.S. regional banks and the forced takeover by Credit Suisse from UBS.

Given that CDS is like insurance and pays out when the company in question defaults, it has been closely watched as an indicator of a company’s financial strength as the current banking crisis has festered. Credit Suisse CDS also rose from less than 400 basis points to more than 1,000 basis points in March, reflecting market concerns about its financial condition, and was acquired by UBS shortly thereafter.

Among Deutsche Bank’s CDS contracts, the most actively traded recently have been dollar-denominated five-year swaps linked to the bank’s senior debt, with at least $51 million in notional transactions in the two days ending last Friday, according to data compiled by the Depository Trust and Clearing Corporation (DTCC). Considering that the reported data for a single transaction is capped at around $5 million, the turnover figure could even be higher.

However, the current CDS market is no longer the same size as it was in its heyday in 2008. According to the International Swaps and Derivatives Association, the global CDS market is now only about $3.8 trillion, almost one-tenth the size it was in 2008.

The CDS market is much smaller than the equity, foreign exchange or bond markets. And that makes the market difficult to navigate, and creates a situation where even small CDS trades can have a huge price impact.

DTCC data shows that Deutsche Bank’s CDS contracts averaged just nine trades a day in the last three months of last year, even though it was already one of the most heavily traded single-name CDS.

Investors in bonds issued by companies, banks or governments can buy CDS through an intermediary – usually an investment bank – which will find a finance company to issue policies for the bonds. These are “over-the-counter” transactions that do not go through a central clearing house.

Regulators call for strict review of CDS market

It is worth noting that Europe’s top regulatory officials are now also calling for a more rigorous review of the CDS market after trading in the market added to the climate of fear in the European banking sector last Friday.

Andrea Enria, chairman of the European Central Bank’s supervisory board, said that “opaque” credit default swap (CDS) transactions are hurting bank share prices and could lead to a run on deposits.

“With a few million euros, you can change the CDS spreads of a bank with trillions of euros of assets, which of course will affect the share price and may lead to a run on deposits, so that’s something that I’m very concerned about,” Enria said at a conference in Frankfurt, Germany.

In response to a question about Deutsche Bank’s share price decline on Friday, Enria noted that the CDS market is “very opaque, very shallow and very illiquid.

He argued that the CDS market should be “more transparent” by having all transactions cleared by a central counterparty and reviewed by a global regulator, the Global Financial Stability Board (FSB). Enria said.

“Intervention is always a last resort for regulators,” Enria said. ‘If you have good transparency, such as having these markets all centrally cleared, rather than having opaque over-the-counter trading – where you don’t know who’s trading at all – I think that would be a huge improvement.”