After analyzing the articles, we have come up with the following recommendations:

- The escalation in food prices can be attributed to various factors like increased costs of energy, labor, transportation, and processing, along with the high profits earned by companies in the food supply chain. This trend is expected to continue for some time, especially in developed countries such as Europe and the United States.

- However, the global food commodity price index has been consistently declining for the past 12 months, and it is now 20.5% lower than its peak level from a year ago. This indicates that the prices of agricultural products have substantially decreased, reflecting a surplus in the global food supply and weak demand.

- Hence, we can anticipate that the gap between agricultural and food prices will diminish over time, with food prices declining and agricultural prices recuperating as costs and profit margins reduce, and government and consumer pressure builds up.

- Based on our analysis, we suggest the following strategies for traders using leverage:

- Adopt a long position in the agricultural market. Identify agricultural products with strong demand and low inventory, such as corn, soybeans, and wheat, and use leverage to increase returns and capitalize on the rise in agricultural prices.

- Take a short position in the food market. Select foods with higher costs and higher profit margins, like meat, dairy products, and sugar, and use leverage to amplify losses and benefit from the increase in food prices.

- Adjust positions based on market conditions. Modify the position ratio and stop-loss and take-profit points promptly, based on changes in agricultural products and the food price index, to avoid excessive leverage or excessive chasing, and manage risks.

We hope that these recommendations will aid traders in making informed decisions in the market.

Original content.

Caixin, April 10 (Editor Xiaoxiang) – More than a year has passed since the outbreak of the Russia-Ukraine conflict, and global energy and food prices, in fact, have long since moved away from the highs touched after the geopolitical crisis event.

However, compared with the fall in oil prices, many areas of the world, especially in Europe and the United States, the public for the decline in food prices, but generally does not seem to feel deeply, even in the eyes of many European and American families, food prices are still becoming more expensive!

It must be said that this is becoming the biggest “oddity” in the field of inflation in Europe and the United States ……

How the global food commodity prices are actually changing, we can actually see from the food price index compiled by the Food and Agriculture Organization of the United Nations. Data released by the Food and Agriculture Organization of the United Nations on 7 March this year, the global food price index has fallen for 12 consecutive months, compared with the historical high of a year ago, a reduction of 20.5%.

The latest data show that the global food price index was last at 126.9 points in March 2023 – the lowest since July 2021. in March 2022, the index had soared to 159.3 points, the highest since the index began in 1990.

The FAO Food Price Index measures international price changes for a basket of food commodities and consists of a weighted average of five commodity price indices: grains, vegetable oils, dairy products, meat and sugar.

There is no doubt that global food inflation should no longer pose much of a challenge if measured simply by this globally recognized FAO food commodity price index, however, this is clearly not the case ……

Food inflation in Europe and the US continues to run high

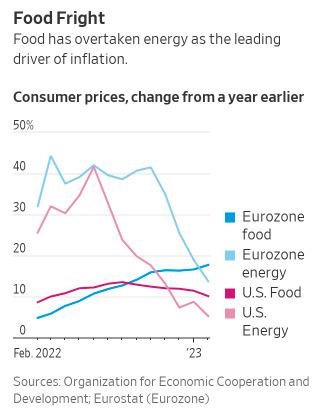

The difference is evident when we break down the food and energy price indicators in the European and US inflation data to make a set of comparisons:

In the 12 months ending in March, food, alcohol and tobacco prices in the Eurozone rose by 15.4%, while energy prices fell by 0.9%.

In the 12 months ending in February, the U.S. food price index rose 10.2% year-over-year, again well above the 5.2% increase in energy prices.

In most countries, food spending now accounts for the largest share of household budgets. While most economists expect food inflation to decline in the coming months, it is clear that consumers will still feel the pain of a shrinking wallet deeply before that day actually arrives.

So why is there such a huge difference between food prices and what consumers feel are real prices?

In essence, it is not really hard to understand.

The FAO’s Global Food Price Index reflects changes in the price of agricultural products themselves, i.e., more of a reflection of the prices available to farmers, but the cost of raw materials is really only part of the price composition of food at the final consumption end, with consumers also paying for processing, packaging, transportation and distribution. And food inflation continues to climb in many countries, also because cheaper agricultural prices are largely offset by increases in other costs such as energy, labor, transportation and processing.

Time to rein in high corporate profits?

Typically, there is a lagged correlation between the price of raw materials and the price paid by households over a period of time. But the current length of the lag and the wide gap in prices between farm and table has led some economists to keenly capture that some other factors may be at work – and that many firms in the food supply chain may have raised prices well beyond what is needed to pay higher costs ……

Claus Vistesen, an economist at Pantheon Macroeconomics, says, “Connecting this to what we’ve seen in price changes for certain agricultural commodities, the only explanation is that ( firms ) are expanding their profit margins.”

Indeed, this scene has raised the alarm of many Western governments!

French President Emmanuel Macron, who is facing recent protests over domestic pension reform, struck a deal last month with the country’s major retailers to keep food prices relatively low.

French Economy and Finance Minister Le Maire said, “We are very aware that what worries all French people and families and makes their daily lives more difficult today is the rise in the price of everyday life, the rise in the price of food.” Le Maire said the agreement, which will last three months until June, will reduce the profitability of food suppliers by “hundreds of millions of euros.

The agreement comes after the Norwegian government also met with representatives of the chain store industry from January this year to consult on price increases for key consumer goods such as food, hoping to make the grocery industry aware of its social responsibility to consumers and ensure that it makes profits while not harming consumers’ interests.

A “profit-price” spiral?

There is evidence that profit margins for food suppliers in Europe and the US have risen sharply since the start of the new pandemic. Economists at ING Bank say margins in the German agricultural sector (excluding packaged food manufacturers and retailers) have increased by 63% from the end of 2019 to the end of 2022.

Rising food inflation also poses a problem for European and U.S. central banks.

Some of the ECB’s rate-setters are now carefully examining the inflationary pressures from expanding corporate margins, with ECB Executive Committee member Fabio Panetta warning of a possible “profit-price spiral.” in a speech last month, Panetta said that “opportunistic behavior by firms could also delay the fall in core inflation.”

For now, while most central bank officials see changes in core inflation (excluding food and energy) as the most critical inflation trend, they also acknowledge that changes in core inflation, including food and energy, will be the most important. But they also acknowledge that headline inflation, which includes food and energy, may be more influential in shaping public expectations.

Food is an indispensable commodity for all households on a daily basis, and rising food prices on the consumer side could lead to calls for wage increases from employees and further feed through to price changes.

Huw Pill, chief economist at the Bank of England, said in a speech last Tuesday that whether food price increases are due to weather, war or profit margins, the central bank may have to respond with higher interest rates.

Pill noted that “persistent deviations between inflation and the central bank’s target, even if they stem from a series of fundamentally temporary inflationary shocks, could prompt changes in popular behavior that could lead to more persistent inflationary dynamics.”

Disclaimers:

Any opinions and information provided by us are for informational purposes only and do not constitute any investment advice or recommendation. Investors are solely responsible for the consequences of any investment decisions made by anyone relying on the information or opinions we provide, and we are not responsible for them.

We are not responsible for any direct or indirect losses arising from the use of or reliance on the information or advice provided by us. Investors should conduct their own research and evaluation of markets, securities and other investment instruments, and make investment decisions within their own risk tolerance.

Please note that investing involves risk and is not suitable for everyone. Investors should carefully consider their investment objectives, risk tolerance and financial situation before making any investment decisions.