Based on the following articles, we can come up with the following trading recommendations:

– Reduce over-reliance on tech stocks and diversify your portfolio appropriately by adding stocks in other sectors, such as consumer goods, healthcare, energy, etc.

– Keep an eye on interest rate trends. If interest rates rise, technology stocks may come under more pressure, and consider selling a portion of your holdings in technology stocks or shorting the technology stock index.

– When selecting technology stocks, pay attention to the fundamentals and growth of the company, do not blindly chase high, but have a reasonable valuation and target price.

– If there is a sharp pullback in technology stocks, you can appropriately buy some high-quality technology stocks and grasp the low absorption opportunity but pay attention to risk control and position management.

The original article is as follows:

In the history of the U.S. stock market, never have a handful of companies from the same industry had such a large influence on the entire market.

The six stocks, namely Apple, Microsoft, Google parent Alphabet, Amazon, chipmaker Nvidia, and Facebook owner Meta, are now said to have a combined market capitalization of about $10 trillion, or more than a quarter of the total market value of the S&P 500.

However, some analysts say this could be bad news for investors.

Soaring stock prices

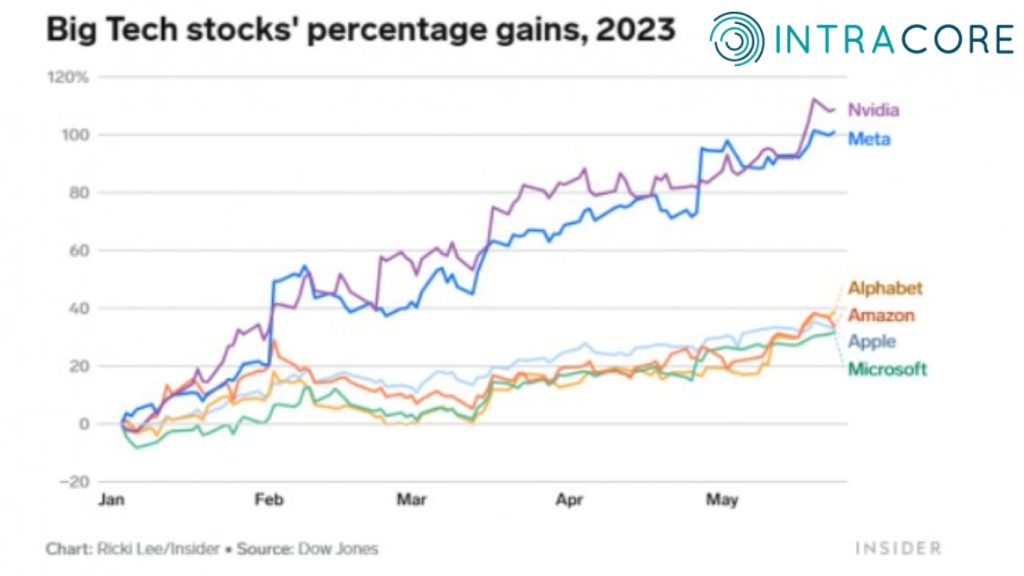

Shares of these companies have both seen double-digit spikes in 2023, with Nvidia and Meta more than doubling their share prices, thanks to the artificial intelligence boom and expectations of an impending pause in interest rate hikes by the Federal Reserve. Most of the S&P 500’s gains so far this year have been caused by the sharp rallies in these individual stocks.

The S&P 500 is up 8% in 2023, but its return would have shrunk to 2% if technology stocks were excluded, as evidenced by the fund price performance of ProShares’ S&P 500 Ex-Technology ETF.

Meanwhile, the S&P 500 has significantly underperformed the tech-focused Nasdaq Composite, which has jumped 22% this year into a bull market.

An unprecedented situation

It is historically rare for a handful of stocks in the same sector to have such a large weighting in the S&P 500.

The last time this situation occurred, where the five most highly valued companies accounted for a quarter of the total market capitalization of S&P 500 components, was in the 1960s, according to Schroders.

Moreover, for the first time ever, the five largest publicly traded companies – now Apple, Microsoft, Alphabet, Amazon, and Nvidia – are all from the same industry (the technology sector).

The vulnerability of the stock market

According to the analysis, it may be easy to see the dominance of large technology stocks as a good thing. But, stocks in the same industry tend to be vulnerable to the same macroeconomic factors, such as rising interest rates, and tech stocks tend to be hit harder than other companies because they are more dependent on borrowing.

The total market capitalization of the S&P 500 is so concentrated in technology stocks that it is more vulnerable than ever too large price swings, said Kathleen Brooks, founder of the analytics firm Minerva Analysis.

When the circle of leaders is small, if something bad happens to the tech sector, the risk is high,” she said. If rates hit 7%, as Jamie Dimon, CEO of Littlemore, warned the other day, that’s bad news for the entire market.”

As a result, she concludes, while large tech stocks are driving an unexpected rally in the U.S. stock market in 2023, their ballooning market caps may end up being more of a curse than a blessing for investors.

Disclaimers:

Any opinions and information provided by us are for informational purposes only and do not constitute any investment advice or recommendation. Investors are solely responsible for the consequences of any investment decisions made by anyone relying on the information or opinions we provide, and we are not responsible for them.

We are not responsible for any direct or indirect losses arising from the use of or reliance on the information or advice provided by us. Investors should conduct their own research and evaluation of markets, securities, and other investment instruments, and make investment decisions within their own risk tolerance.

Please note that investing involves risk and is not suitable for everyone. Investors should carefully consider their investment objectives, risk tolerance, and financial situation before making any investment decisions.