Traders will understand that the Fed may raise interest rates once more this year, which is positive for the US dollar and US Treasury yields, and negative for gold and other commodities.

Therefore, beginners can make the following trading recommendations based on their risk appetite and investment objectives:

- If a beginner is bullish on a stronger dollar, he or she can buy the dollar against other currencies, such as the dollar against the yuan or the dollar against the euro.

- If you are bullish on rising U.S. Treasury yields, you can sell U.S. Treasuries or buy Treasury futures contracts.

- If a beginner is bearish on gold and other commodities, he or she can sell gold or buy commodity futures contracts.

How to adjust your trading strategy according to market conditions

Of course, these trading recommendations carry some risk, and beginners need to be aware of market movements and their own stops.

Additionally, novices should bear in mind that the likelihood of a Fed rate increase is not certain. If there are unexpected market conditions, such as a drop in inflation or an economic slowdown, then the Fed may suspend rate hikes or shift to rate cuts, which would have a reverse effect on the above trading recommendations.

Therefore, it is important for beginners to maintain a flexible mindset and strategy and to adjust their positions and direction at all times.

The original article is as follows:

Caixin, May 26 (Editor Zhao Hao) – Traders fully priced in a 25 basis point Fed rate hike in the next two months during the New York session on Thursday (May 25).

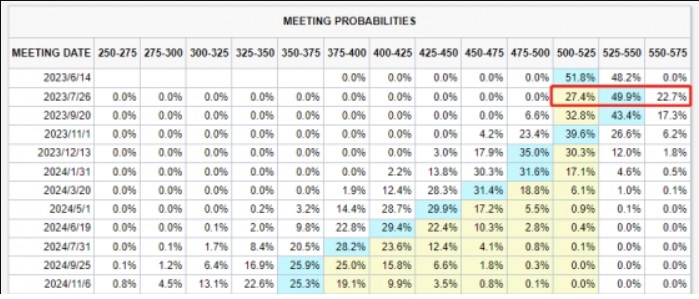

Swap contracts linked to the Fed’s session showed that traders expect the effective federal funds rate to rise to 5.37 percent in July, 25 basis points above the current level, while the June contract is 14 basis points higher.

This means that the market believes the bank will raise rates by a total of 25 basis points at the next two policy meetings, meaning that the June meeting and at least one of the July meetings will be a rate hike. As for which meeting the rate will be raised, the market shows a “50-50” probability.

Change in Market Sentiment Since Early May

But a series of recent data shows that the U.S. economy is very resilient, increasing the possibility of further tightening by the Fed. U.S. 2-year Treasury yields, which are more sensitive to policy rates, have maintained a steady rebound in the last 10 trading days, rising above the 4.5% mark during the day, which is the highest level since early March.

Fed Governor Waller Suggests a Pause in June Rate Hike

Yesterday, Federal Reserve Governor Christopher Waller said that even if interest rates remain unchanged in June, the bank may still need to raise rates later this year. Because he believes that the bank should not end the tightening cycle until there is clear evidence that inflation is cooling.

Waller mentioned that “three medium-sized banks have collapsed this year, clearly increasing uncertainty. Out of caution, I would suggest a pause in June. If credit and bank conditions remain unchanged in July, then it would be appropriate to continue raising rates at the end of July meeting.”

Market Reaction and Outlook

Media analysis says the danger of back-to-back bank storms has diminished, and also that the bipartisan bickering in Congress around the debt ceiling has had a more limited effect on tightening financial markets.

Priya Misra, head of global interest rate strategy at TD Securities, said the market is still assuming a bipartisan debt ceiling deal will be reached and there is no material reduction in spending by Americans, “The Fed might raise rates one more time, but that would just increase the number of rate cuts needed next year.”

Disclaimers:

Any opinions and information provided by us are for informational purposes only and do not constitute any investment advice or recommendation. Investors are solely responsible for the consequences of any investment decisions made by anyone relying on the information or opinions we provide, and we are not responsible for them.

We are not responsible for any direct or indirect losses arising from the use of or reliance on the information or advice provided by us. Investors should conduct their own research and evaluation of markets, securities, and other investment instruments, and make investment decisions within their own risk tolerance.

Please note that investing involves risk and is not suitable for everyone. Investors should carefully consider their investment objectives, risk tolerance, and financial situation before making any investment decisions.

Get Access from https://www.intracore.co to know more.