Based on the below article, we can come up with the following suggestions on how to make leveraged trades based on the banking crisis:

1. Before the outbreak of the crisis, you can short some regional banks with problems, such as Silicon Valley Bank and Signature Bank, in advance based on the warning signals of some short sellers, in expectation of high gains after the crisis. This approach requires strong market insight and risk tolerance, as there may be a risk of regulatory intervention or market rebound.

2. After the outbreak of the crisis, you can select some overly suppressed bank stocks, such as First Republic Bank, to go long against the trend based on the decline in stock prices and the increase in short positions, in the expectation of rebound gains after the market regains confidence. This approach requires a high degree of resilience and patience, as there may be a risk of a sustained run or market panic.

3. During the ongoing crisis, you can select some relatively stable bank stocks, such as Cazenove, for high-frequency trading in anticipation of short-term swing gains, based on stock price fluctuations and market sentiment. This practice requires strong technical analysis skills and execution, as it may be subject to the risk of market changes or operational errors.

The following article is inside:

Caixin, April 10 (Editor Xiaoxiang) – Short selling always seems to be a controversial market practice no matter when and where it occurs.

During the 2008 financial crisis, short selling was heavily blamed for increasing market volatility and was once banned – albeit to little effect. In the aftermath, some prominent short sellers were praised for successfully “warning” of the U.S. subprime mortgage crisis.

And in the past month, a similar drama is playing out once again ……

As the Federal Reserve’s aggressive rate hikes over the past year have caused the value of long-term assets held by some banks to shrink significantly, problems have begun to accumulate for U.S. regional banks. Some lenders are also facing the challenge of a “cold winter” for cryptocurrency and technology companies. Last month, when depositors fled in an out-of-control run and regional banks’ stock prices took a general hit, the “big lightning” that was lurking was completely detonated!

The crisis of confidence in U.S. regional banks began on March 8, when Silicon Valley Bank announced it would raise capital to cover nearly $2 billion in losses from the sale of securities. Just two days later, U.S. regulators announced they were taking over the “collapsed” bank, dragging down the share prices of a host of other regional banks. That same weekend, New York-based Signature Bank also declared bankruptcy. By mid-March, First Republic’s stock had fallen by more than 80%.

Now, exactly one month after the Silicon Valley bank collapse, many in the industry are turning their attention to the large number of bank short sellers who were initially less visible – to what extent did these short sellers contribute to the stock market’s downward spiral?

Did they play the role of “whistle blowers” for the crisis, or were they simply “speculators” who profited from the pain of others?

The answer is probably a bit of both, judging by the wealth of post-mortem data and the rhetoric of the short sellers ……

There were indeed “whistle blowers” before the banking crisis

To be sure, there were a number of sharp “whistle blowers” prior to the current U.S. banking crisis, and some short sellers expressed their negative views on regional banks such as Silicon Valley Bank in public early on.

Short seller Jim Chanos said in a March 13 letter to clients that some investors had actually known about Silicon Valley’s underlying balance sheet problems last summer, but it wasn’t until the bank “suddenly tried to raise capital …… that people started to really pay attention.

Chanos shorted the bank, which burst into flames last month, very early on. And according to interviews and public releases, at least a few other short sellers besides Chanos had been shorting regional banks long before the crisis broke out, including

William C. Martin: shorted Silicon Valley Bank in January 2023;

Nate Koppikar, co-founder of Orso Partners: shorted Silicon Valley Bank in early 2021

Barry Norris, founder of Argonaut Capital Partners, a hedge fund: shorted Silicon Valley Bank in late 2022;

John Hempton, Fund Manager, Bronte Capital Management: shorted Signature Bank in late 2021

Marc Cohodes: shorted Silvergate Bank in November 2022

……

Porter Collins, co-founder of hedge fund manager Seawolf Capital, said he realized early on how rising interest rates could hit banks and shorted Silicon Valley Bank, Signature Bank, First Republic Bank, Silvergate Bank and Carlson Financial in early 2022.

“There were warning signs that were easy for those who were watching carefully to catch,” he said.

An army of greedy ‘speculators’

However, behind the role of crisis “whistle blowers,” it is also clear that one cannot ignore the fact that a large number of short sellers did contribute significantly to the decline in bank stocks and market fears, especially since their actions themselves had an unpredictable snowball effect ……

Dennis Kelleher, president and CEO of Better Markets, a nonprofit industry group, said, “Short sellers actually warned the market accurately months before the banking meltdown that Silicon Valley banks were highly dangerous due to mismanagement. The problem, however, is that once the lightning storm did occur, more short sellers stepped up their efforts to short the banking sector for a variety of motives.”

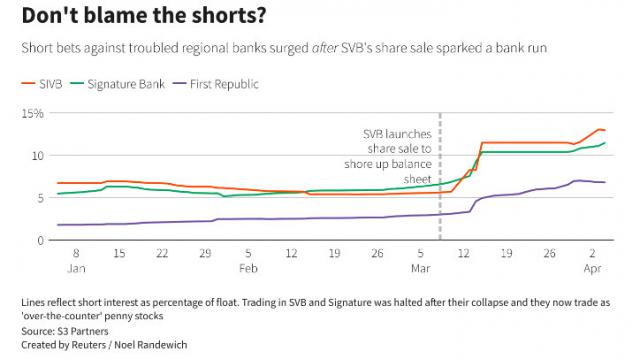

According to data-tracking firm S3 Partners, short positions as of early last month actually started out at only about 5% of the number of outstanding shares of Silicon Valley Bank, about 3% of First Republic Bank and about 6% of Signature Bank. Statistics from S&P Global Markets and ORTEX both came to similar conclusions.

However, as the banking crisis festered in March, short positions in these bank stocks began to increase en masse. By the end of March, First Republic Bank had a short selling ratio of up to 39%, Silicon Valley Bank up to 19% and Signature Bank up to 11%, according to the three institutions mentioned above.

According to people familiar with the matter, First Republic Bank even feared at its most critical moment last month that the massive short-selling buildup could exacerbate its woes after its shares continued to plummet by double digits. As the crisis intensified, J.P. Morgan equity analysts also reported on March 17 that short sellers were “collectively driving a run on the bank.

According to S3, overall short-selling gains on U.S. regional bank stocks reached $4.76 billion in March, a 35% return based on an average short position of $13.4 billion.

Venture capitalist David Sacks couldn’t help but ask on Twitter: Are the “scumbag short sellers” using social media to fuel the exodus of depositors from Silicon Valley banks?

And in any case, one month into the U.S. banking crisis, while people may have survived the initial market turmoil, there are still many questions and unanswered questions.

The short sellers of bank stocks, who now present themselves as victors, will be judged on their merits and demerits.

Disclaimers:

Any opinions and information provided by us are for informational purposes only and do not constitute any investment advice or recommendation. Investors are responsible for the consequences of any investment decisions based on the information or opinions we provide, and we are not responsible for them.

We are not responsible for any direct or indirect losses arising from the use of or reliance on the information or advice provided by us. Investors should conduct their own research and evaluation of markets, securities and other investment instruments, and make investment decisions within their own risk tolerance.

Please note that investing involves risk and is not suitable for everyone. Investors should carefully consider their investment objectives, risk tolerance and financial situation before making any investment decisions.